RailsConf 2015

5 Secrets We Learned While Building a Bank in 16 Months

5 Secrets We Learned While Building a Bank in 16 Months

by Stan Ng and John PhamvanThe video titled "5 Secrets We Learned While Building a Bank in 16 Months" features speakers Stan Ng and John Phamvan sharing their journey of transforming Payoff from an internet company focused on personal finance management into a financial institution aimed at helping individuals overcome credit card debt. The key points discussed in the video include:

- The Evolution of Payoff: Initially a personal finance management company, Payoff sought to create a bigger impact by transitioning into a lender to assist consumers in managing debt.

- Understanding User Needs: By profiling a typical user named Ashley, the team illustrated the challenges many face with high credit card interest rates, despite responsible payment habits.

- Strategic Code Rewriting: Recognizing the limitations of their old codebase, the team undertook a challenging rewrite of their 500k lines of C# code to transition to a more agile Ruby system, which significantly improved their software development efficiency.

- Hiring and Culture: Emphasizing a nurturing company culture, they aimed to hire nice people and prioritize work-life balance, understanding the importance of a positive, supportive workplace.

- Learning and Expertise: The rapid transition to lending required the team to educate themselves on compliance and the intricacies of the finance world, fostering a culture of continuous learning and improvement.

- Communication and Values: The company focused on maintaining open communication, nurturing talent, and integrating diverse perspectives, which are vital in a tech-oriented financial setting.

- Conclusion: They highlighted the broader mission of restoring humanity to finance and the importance of prioritizing employee well-being alongside business success.

The overarching conclusion from the video is that building a company in the tech and finance sectors can be successful without sacrificing personal values and quality of life, making it possible to foster innovation while empowering employees to maintain a healthy work-life balance.

00:00:11.530

My name is Sean, the VP of Engineering at Payoff, and this is Stanley and John. We're here to talk a little bit about what we've been up to over the last year and a half. We want to share our story of how we transitioned from an internet company to a financial institution.

00:00:34.699

We came from internet company roots and did that for a while. However, we realized we wanted to have a much bigger impact. We didn't set out to create a non-profit but to help people get out of debt.

00:00:45.890

Our objective was to make a significant difference, and we approached it by leveraging open-source resources. If you've heard about Payoff, that's not particularly surprising. We started in 2009 as an internet company focused on personal finance management.

00:01:04.699

We aimed to help consumers improve their financial habits through a badge and behavior-change system. Think of us as similar to Mint.com, but our approach incentivized positive financial behaviors. For example, instead of 'killing zombies' for badges, users earned them for making six payments on time.

00:01:22.009

This was our version 1.0. Now, we are developing what we call Payoff 2.0, which incorporates even more features to help users manage their finances. Payoff 2.0 emphasizes refinancing as a means to alleviate credit card debt.

00:01:38.150

To illustrate how this works, let me introduce you to Ashley, a typical user. She is in her late 20s, well-educated, and technologically savvy. However, she has accumulated some credit card debt, which is a prevalent issue that many don’t discuss. Studies show many people are more willing to talk about having cancer than being in credit card debt—a testament to how common yet stigmatized this problem is.

00:02:11.130

We wanted to tackle how credit cards operate today. When you get a credit card, it often feels like an invitation to spend money you don’t actually have. That's how credit pricing works; it is based on the perceived risk.

00:02:34.699

For instance, when a fresh graduate receives their first credit card, they often pay an interest rate of 20-24%, while someone like Ashley—who has been making timely payments and has a credit score of about 700—may still end up paying the same high rate, which doesn’t reflect her current risk.

00:03:02.500

The typical situation is that these consumers are caught in a treadmill of paying just enough each month to avoid accumulating more debt. Our goal with Payoff is to offer them a means to refinance at a lower interest rate, thus allowing them to pay off their debt more quickly.

00:03:24.090

As a result, we aim to restructure the financial environment in which these debtors operate—empowering them financially. We are a venture-backed company striving to provide a sustainable business model that focuses on helping our customers while also being profitable.

00:03:49.500

It’s important to clarify: we are not a non-profit. We can indeed be financially sound while still supporting our clients. This belief permeates our culture as a startup. Here's a look at some of our early struggles.

00:04:09.700

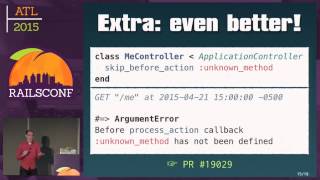

When we started, we had a massive monolith, over half a million lines of code with 0% test coverage. Every deployment was accompanied either by celebration or a strong need for a beer after surviving what felt like chaotic implementations. It was extraordinarily painful, taking days just for QA analysts to process what small updates looked like.

00:04:37.060

Recognizing that we couldn’t keep functioning like this, we decided to undertake a risky rewrite of our codebase. It took eight weeks of night and weekend work, and I can’t stress how intense those weeks were. We needed to modernize our approach, switching from our traditional methods to something more agile.

00:05:00.960

By the end of that period, we had rewritten approximately 14,000 lines of code with a pass rate of about 70%. The rewritten code was designed to be more accessible and manageable.

00:05:25.110

Two months later, after our prototype was complete, our CEO presented us with a major challenge: we were going to become a lender. This was a shocking pivot for us, as no one on the team had any prior experience with lending.

00:05:49.540

Within 16 months, we found ourselves needing to understand compliance and security aspects while also delivering a product. We dove into the murky waters of finance that were intimidating and complex.

00:06:10.920

While we learned quickly, we also realized that changing the perception of what it meant to lend money and facilitate financial health was crucial. We understood that it was imperative to surround ourselves with individuals who comprehended these challenges.

00:06:30.680

The culture we cultivated was intentional. We constantly discussed the nurturing environment necessary for creativity and growth. We made it paramount to focus on family, acknowledging that many of our employees already had families to care for.

00:06:54.920

We recognized that balancing work-life integration was essential. We focused on hiring nice people, which contributed to our overall performance. We decided it was not only about productivity but also about creating a supportive environment.

00:07:15.920

Our early team was built on personal relationships where being friendly and willing to collaborate mattered. We averred against creating any unnecessary hierarchy while also ensuring the company culture fostered healthy relationships and open communication.

00:07:38.250

When we scaled, we understood the dynamics of working with a larger team. Every interaction in the sprawling web of a larger company became essential. We also made a conscious effort to reduce genres and documentations, leaning into conversation and relationships instead.

00:08:02.730

Moving to more open seating, comfortable environments, and social interactions was critical. Our office space has couches and spaces for casual engagement but requires a well-thought strategy to support these initiatives.

00:08:29.120

We also brought in substantial leaders who understood and internalized thoughtful approaches to culture and finance. We based much of our massage on these cultural foundations and sought balance between technical excellence and humane interaction.

00:08:46.319

The core tenets of seeking balance, shared values, and human empathy were essential in shaping Payoff's direction. However, as we transitioned, we then began realizing we also needed to bring experts in finance to assess what these values looked like in practice.

00:09:05.250

Often, I find that companies set technology as a separate entity from business practices, and that’s where we didn’t want to go. Engaging in employee conversations and making them truly valuable would be our selling point.

00:09:26.540

We emphasized the importance of speaking about financial issues among different departments to cultivate complete awareness. Knowing how to talk to one another is the secret sauce as we look to restore humanity in finance.

00:09:45.880

One notable challenge was adjusting how we onboard staff coming from vastly different corporate backgrounds. We understood that learning styles varied, and traditional company culture wouldn’t take our company far. This reevaluation informed how we continued to scale.

00:10:07.090

As we began onboarding new engineers, we further deepened our commitment to hiring nice people—individuals who were capable of working well within a team. Cultural fit became a priority alongside competency.

00:10:28.460

We put a unique emphasis on our hiring practices as part of our evolution. We valued candidates who could demonstrate a willingness to learn as opposed to simply meeting a predetermined set of skills.

00:10:49.870

We made strides to articulate our expectations differently. In effect, our job postings would state that we were not looking for the perfect candidate but the right attitude—in essence, someone willing to grow.

00:11:12.440

It’s common for many organizations to opt for individuals who fit the mold. Yet, as our team grew, we redirected this narrative and instead focused on nurturing talent and potential.

00:11:33.260

During this transition, we recognized growth pains. We initiated with four engineers. However, as we expanded our teams, internal processes shifted due to the consequential changes in communication.

00:11:54.390

Coalescing company values while navigating these shifts was paramount. Emphasizing team communication and ensuring that novices felt engaged would allow us to maintain our nurturing environment.

00:12:09.750

Important to us was how being nice translates into productivity. Other factors such as diversity and employee morale became central to our success but needed to be built in a thoughtful manner.

00:12:32.030

Ultimately, striving for values that facilitate kindness resulted in positive outcomes. Your team’s composition should resemble your overall goals, which means integrating people who not only bring diversity but affirmative attitudes as well.

00:12:53.440

We recognize our strides towards creating an extraordinary company culture but understood that it’s an ongoing commitment. This is especially important while navigating finance and tech spaces, making sure our innovations did not lose sight of these values.

00:13:13.570

The importance of this extends outside our walls. We wanted to disseminate the message that startup life does not have to be equated with relentless grind; rather, we want to put humanity back into the conversation surrounding finance.

00:13:36.060

As we close, remember our journey is about striving for better practices within startups, fostering innovation without sacrifices. Family time should never be something you trade for business milestones. We embrace a commitment to run our operations and respect our people's lives outside of work.